GOBankingRates works with many financial advertisers to showcase their products and services to our audiences.

These brands compensate us to advertise their products in ads across our site.

This compensation may impact how and where products appear on this site.

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information.

you’ve got the option to read more about oureditorial guidelinesand our products and servicesreview methodology.

Instead, your money works for you.

And if youre already well on your way to retirement, congratulations.

Today, more Americans are retiring than ever before.

Over 4.1 million Americans will turn 65 each year through 2027 thats more than 11,200 every day.

However, if youre planning to retire soon, you dont want to make any financial mistakes.

If your employer offers a 401(k) match, you must elect for it.

An employer match is essentially free money, so dont leave it on the table.

Underestimating Your Future Healthcare Needs

One of the best things about turning 65?

You become eligible to enroll in Medicare.

However, Medicare doesnt cover all healthcare expenses.

Additionally, Medicare involves monthly premiums, deductibles, and prescription drug costs.

In other words, expect to have additional medical expenses in retirement even though you enroll in Medicare.

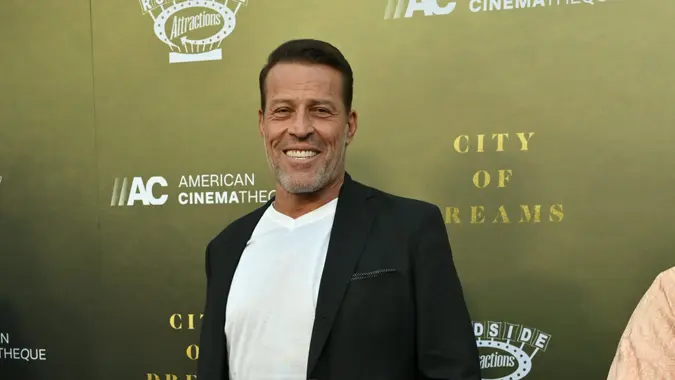

Money has no power by itself,only the poweryou give it, his website states.

Thats why mindset your ability to focus and the state you put yourself in is the ultimate power.

More From GOBankingRates

Share This Article: