GOBankingRates works with many financial advertisers to showcase their products and services to our audiences.

These brands compensate us to advertise their products in ads across our site.

This compensation may impact how and where products appear on this site.

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information.

you might read more about oureditorial guidelinesand our products and servicesreview methodology.

One in five Americans (20%) doesnt have savings at all.

While saving is important, its not the only way to build wealth.

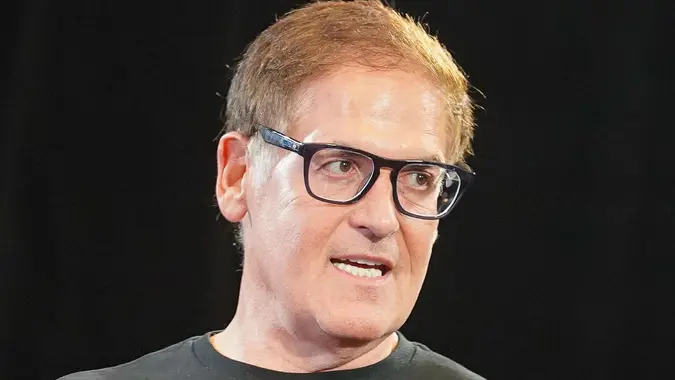

In fact, billionaire Mark Cuban argues thatyou shouldnt just save you should invest instead.

GOBankingRates broke down Cubans advice on prioritizinginvesting your moneyover saving it.

The top 1% doesnt just save.

They aggressively invest in things like real estate and alternative assets (like gold IRAs).

A2025 CAIS-Mercer studysupports this idea.

Of the financial advisors surveyed, 92% said they allocate their funds to alternative investments.

Nearly all of them (91%) said they intend to increase allocations in the future.

After all, those yields may not even keep up with inflation.

But you might still want to have a little savings.

you could save money for short-term goals anything that takes under a year.

But if you have long-term goals anything over a year investing is generally smarter.

After one year, youd have roughly $52,000.

In 10 years, youd have around $74,000.

This assumes nothing changes in that account no withdrawals, deposits or changes in yield.

Now say you invest $50,000 in the stock market instead.

According toInvestors.com, the stock market has seen an average annual return of 10.8% over the past decade.

Assuming average returns and no additional contributions, youd have nearly$140,000after 10 years.

Thats nearly double all because you invested.

When you think even longer term, you could potentially be losing out on a lot more than that.

Saving for a rainy day or for an emergency fund is not a wise financial move in my opinion.

This could cost you millions in retirement.

Instead, all savings should go into investing.

Essentially you are still saving, youre saving for retirement.

Saving comes with an opportunity cost, meaning the loss of a potential gain.

it’s possible for you to always use a credit card for a true emergency.

Put that money towards investing in your retirement instead.

Take Your Risk Tolerance Into Account

Not everyone has the same risk tolerance.

And not everyone is in the same place in life financially.

While going straight to investing might work for some, its not the best move for everyone.

Consider your goals and needs when choosing what to do with your money.

When in doubt, speak with a professional for advice.

More From GOBankingRates

Share This Article: