GOBankingRates works with many financial advertisers to showcase their products and services to our audiences.

These brands compensate us to advertise their products in ads across our site.

This compensation may impact how and where products appear on this site.

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information.

you’ve got the option to read more about oureditorial guidelinesand our products and servicesreview methodology.

Over 67 million American retirees receive a monthly Social Security check, but the program is facing a crisis.

Without changes, future generations wont receive 100% of their benefits.

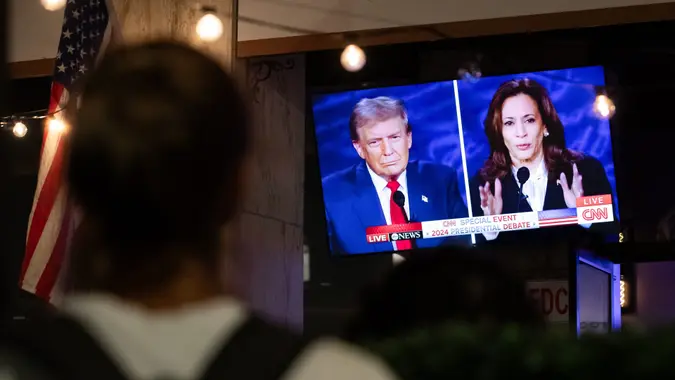

The CRFB is not alone in evaluating how Trumps proposals could negatively affect Social Security.

Tax Social Security Benefits

Trump has not wavered from his idea of ending Social Security benefits taxation.

While this proposal sounds great to many retirees, not all voters are on board.

Johnson doesnt believe the plan is realistic.

By eliminating taxes on these benefits, the program would lose a crucial source of revenue, Johnson explained.

He added, Social Security is already facing financial challenges, and reducing its income could worsen its stability.

Right now, people stop paying Social Security taxes after earning around $168,600, Johnson stated.

If they raised that cap, higher earners would continue contributing more to the system.

This limit is increasing to $176,100 in 2025, but its afairly nominal increaseunlike what Johnson is proposing.

He added, This could bring in additional funds and help delay the depletion of Social Security.

However, he emphasized that people close to retiring should not be affected.

It could help balance the programs finances in the long term, he said.

Trump says hell eliminate taxes on Social Security benefits, but that might hurt the programs solvency even more.

I want to seereal, detailed plansfrom both before making my decision.

More From GOBankingRates

Share This Article: