GOBankingRates works with many financial advertisers to showcase their products and services to our audiences.

These brands compensate us to advertise their products in ads across our site.

This compensation may impact how and where products appear on this site.

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information.

you’re free to read more about oureditorial guidelinesand our products and servicesreview methodology.

Wealthy corporations and individuals lauded this tax overhaul.

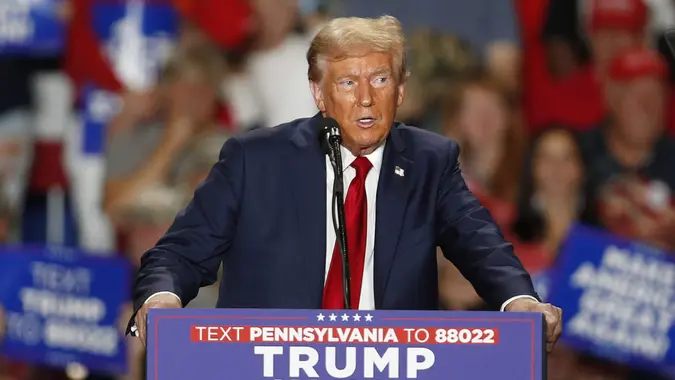

But what would a Trump win in the upcoming presidential election mean for the tax burden on the poor?

It may depend who you ask.

Why exactly is that?

This means that as taxes are reduced, the top 1% pay more in taxes.

How does that make sense?

When you reduce [the tax rate], the top 1% evades less and pays more.

Does the data always support this?

It could, but it may not.

The Laffer Curve is best regarded as a theoretical jumping off point and not a definitive hypothesis.

Still, the poor pay almost no taxes, stated Smith.

What about residual effects?

But, according to Smiths above assessment, this logic could be false.

But would the reality of losing these programs become any less real?

Trump did attempt to repeal and then subsequentlysabotagethe Affordable Care Act.

Do others agree?

import taxes) that would hurt low-income Americans the most.

The upper 1%, however, would see a 1.4% increase in after-tax income.

More From GOBankingRates

Share This Article: