GOBankingRates works with many financial advertisers to showcase their products and services to our audiences.

These brands compensate us to advertise their products in ads across our site.

This compensation may impact how and where products appear on this site.

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information.

you could read more about oureditorial guidelinesand our products and servicesreview methodology.

Heres everything to know.

If you received $5,000 or more from different apps, you will receive multiple 1099-K forms.

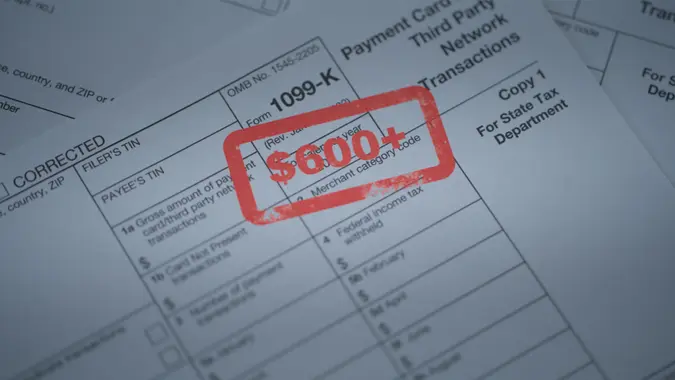

Before ARPA, taxpayers had to report third-party app payments of $20,000.

However, ARPA cut the threshold to $600 with no minimum number of transactions.

The following are examples of what is not counted towards the income threshold.

To avoid confusion, the IRS recommends labeling these transactions as non-business in payment apps.

You dont need to report both, as reported byCNET.

For questions or concerns, speak to a professional tax expert regarding a 1099-K form and how to file.

More From GOBankingRates

Share This Article: