GOBankingRates works with many financial advertisers to showcase their products and services to our audiences.

These brands compensate us to advertise their products in ads across our site.

This compensation may impact how and where products appear on this site.

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information.

you’re able to read more about oureditorial guidelinesand our products and servicesreview methodology.

Perhaps most striking is the suggestion to replace federal income taxes with a tariff-based funding system.

Businesses and entrepreneurs may also benefit from fewer financial constraints, allowing for expanded growth opportunities.

Tariffs: A Hidden Tax for Consumers

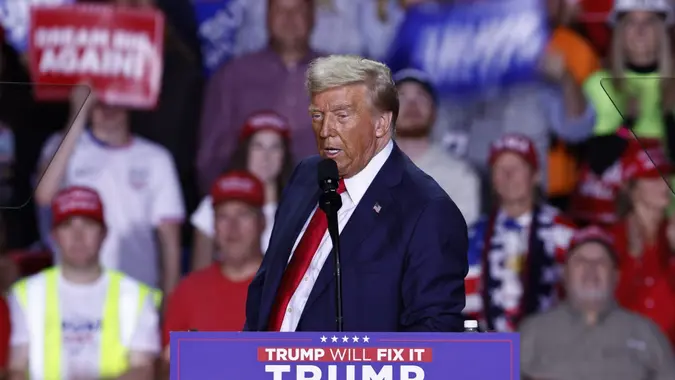

Tariffs have long been a centerpiece of Trumps economic vision.

Certain sectors, such as manufacturing, could experiencerenewed investment and growth.

While these measures appeal to proponents of economic nationalism, they come with a mixed bag of consequences.

The Perks:These policies could provide U.S. manufacturers with a competitive edge, creatingnew investment opportunitiesin domestic markets.

For affluent investors, this opens avenues to capitalize on industrial growth.

These policies created lucrative opportunities fordevelopers and investorsbut also sparked concerns about wealth inequality and gentrification.

Deregulation could also lower costs, encouragingmore expansive development projects.

The Costs:These benefits have sparked concerns about gentrification and wealth inequality.

Critics argue that such policies primarily enrich developers while displacing vulnerable communities and widening economic disparities.

It could also boost private healthcare options, offering tailored solutions for wealthy individuals.

More From GOBankingRates

Share This Article: