GOBankingRates works with many financial advertisers to showcase their products and services to our audiences.

These brands compensate us to advertise their products in ads across our site.

This compensation may impact how and where products appear on this site.

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information.

you’re able to read more about oureditorial guidelinesand our products and servicesreview methodology.

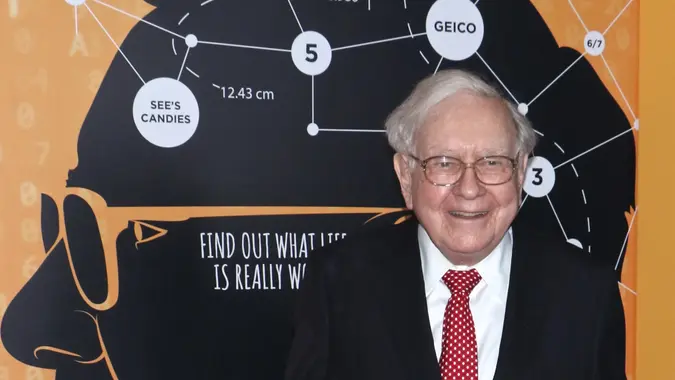

Berkshire did grow its position in a few companies late last year, however.

Heres a look at the three companies and whether theymight make good buys in 2025.

Berkshire Hathaway currently owns roughly 28.2% of Occidental.

Analysts atZacksrecently called Occidentals stock price undervalued based on internal valuation metrics.

SiriusXM alone reaches a combined monthly audience of 150 million listeners.

Berkshire Hathaway has been adding shares of Sirius XM to its portfolio since the third quarter of 2023.

Thats the case even though the company recently forecast lower revenue and EBITDA in 2025.

The financial health and growth prospects of SIRI demonstrate its potential to outperform the market, Zacks added.

It also churns out steady profits.

More From GOBankingRates

Share This Article: